WHY WAVE?

There are a bunch of different online bookkeeping options available, but the reason I’m sharing about Wave is because it’s completely free.

You’re probably thinking, what’s the catch? There are some sidebar ads on the site so that Wave can make money, but they aren’t in your face and I’ve actually learned to tune them out. You aren’t charged if you have more than five clients or want to categorize more than 15 transactions a month. The only time fees come into play is if you use their payment processor to collect payments or if you use their payroll system.

WHO SHOULD USE WAVE?

Wave is great for freelancers and service-based small business owners. It allows you to invite your accountant to view your accounting without having to give them your login info. Wave isn’t the best if your primary source of income is selling inventory. If you want in-depth reporting beyond the basic profit and loss statement and balance sheet, you will want to check out Quickbooks Online or Xero.

If you don’t currently have a bookkeeping system in place, I recommend starting with the new year. Going back and trying to do all 12 months in your new bookkeeping software will overwhelm you and you won’t want to do it. By starting with January, you’ll have a fresh slate and you’ll be more likely keep up with it throughout the year.

GETTING SET UP

- Create a business account here.

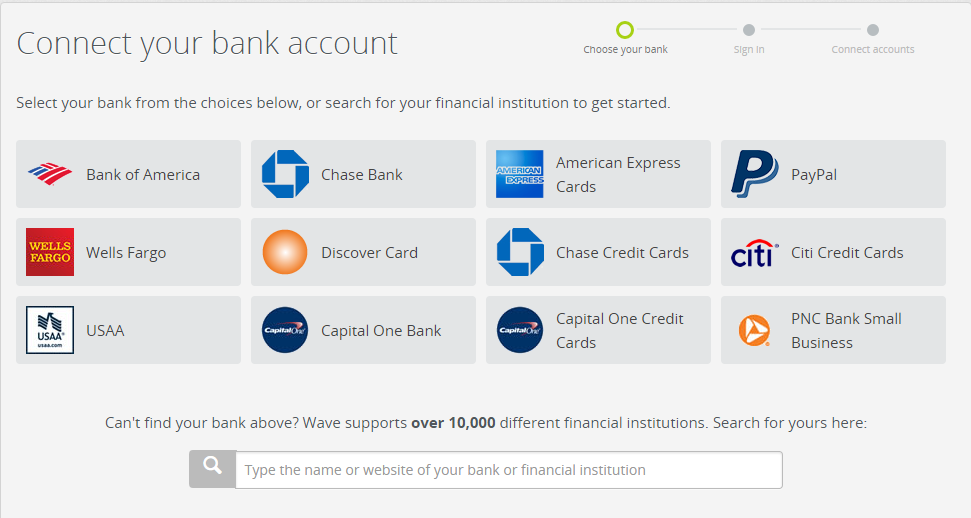

- Link your bank accounts, credit cards, and other payment collection accounts like PayPal.

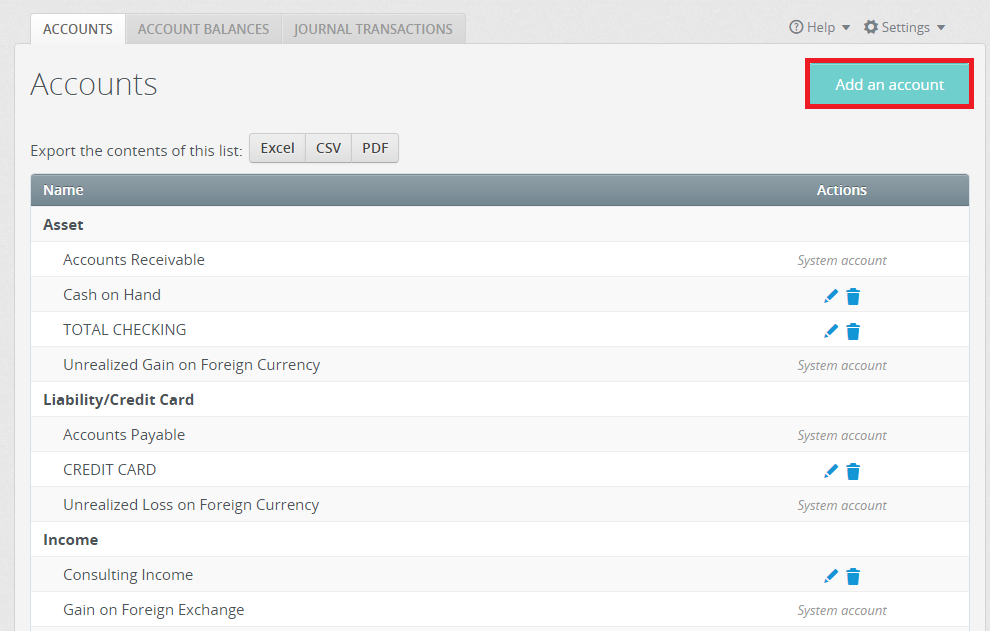

- Set up your chart of accounts.

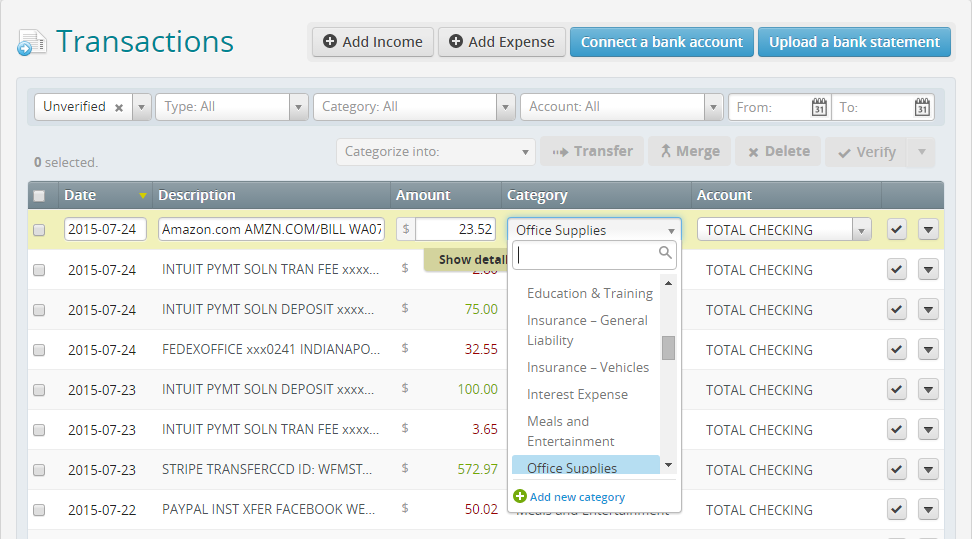

- Click on the Accounting tab on the left side of the screen. Here you can add/edit/remove different income and expense categories. You can also add income or expense categories when you’re assigning a category to a transaction. Simply click on “Add a new category” and a screen will pop up for you to add the category you need.

MONTHLY TASKS

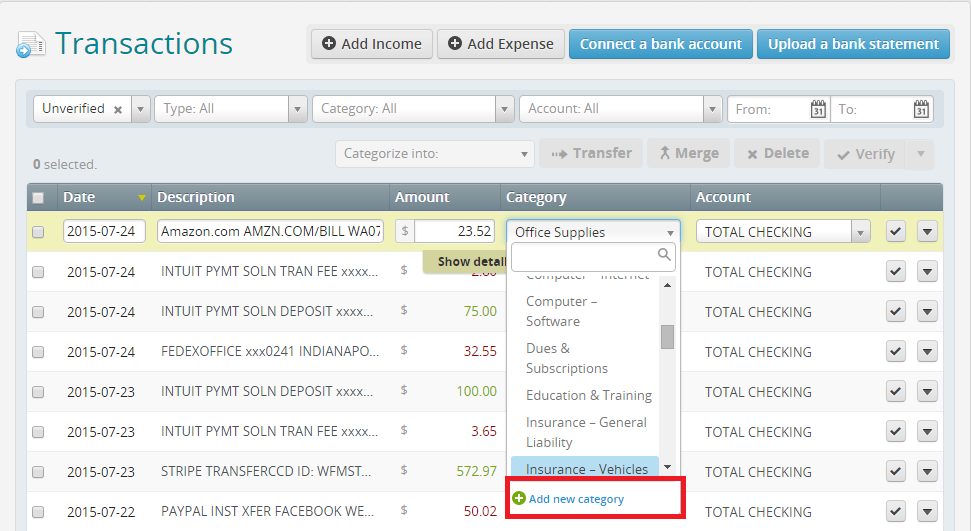

- Categorize your income and expenses.

- Categorize transfers from one account to the other. For example, if you receive payments through PayPal, record the transaction that takes the money out of PayPal and the transaction that puts the money into your bank account as a transfer.

- Reconcile each account you’ve linked to Wave.This is like balancing a checkbook. During this process, you’ll see if any transactions were left out or double-counted.a. Make sure this drop-down menu shows “Unverified” so you can see the unreconciled transactions.

- In this drop-down menu, select the account you will reconcile.

- Select the dates that correspond with the bank statement. Sometimes statements align with the month-end and sometimes they start and begin mid-month.

- Enter the ending bank balance from the account’s monthly statement.

- Go line by line through your paper bank statement and check off the transaction on paper and on screen.

- Once you’re done, the “Difference” should show a big fat zero.

Feeling lost about how to handle bookkeeping and everything money in your business? Amy’s course Be Your Own CFO is here to save the day. Learn how to setup your business legally, how to correctly use bookkeeping softward and much more. She’s generously offered FTFers $75 dollars off- just use coupon code FREELANCETOFREEDOM to get it! Don’t wait til tax time and get caught with your pants down!

These are the basic tasks in getting your bookkeeping set up and operating on a monthly basis. Some freelancers will have very simple bookkeeping and some will have more involved and difficult bookkeeping.

If you feel like you’re in over your head, don’t throw in the towel and give up. Contact a bookkeeper that specializes in cloud bookkeeping. Many offer a training option where they do an on-screen tutorial of the program using your actual transactions.

Once you get a couple of months under your belt, it gets so much easier!